How to save money on house insurance in South Alabama

So, you’re buying or building a home in Mobile or Baldwin County. What you probably don’t know is that one type of home may have expensive insurance rates while another home may have cheap insurance rates. Let me show you all of the things you need to save money on house insurance in South Alabama. Here’s what style of houses get the cheapest insurance on the Gulf Coast:

Very quickly, here is a preview of what will save money on house insurance in South Alabama:

- A home 20+ miles from the bay and 2+ miles from the gulf (the farther, the better).

- A home within 5 miles of a fire department and within 500ft of a fire hydrant.

- A relatively new house or a house with new updates.

- A house with a hipped roof is best (must be ¾ hipped).

- A brick house is best and hardi board is 2nd best. DO NOT get a stucco house.

- A house with a metal roof is best, but architectural shingles are cheaper and more common.

1) Distance from the water

Hurricanes are Southern Alabama’s main problem. The closer your house is to the water, the riskier it is to insure. Insurance price reflects a home’s risk of being damaged. Here’s an example of what house insurance may cost a 150k house at different distances from the Gulf of Mexico:

- $950 – If house is North of I-10.

- $1150 – If house is 20+ miles from Gulf.

- $1200 – If house is 15+ miles from Gulf.

- $1300 – If house is 10+ miles from Gulf.

- $1550 – If house is 6+ miles from Gulf.

- $1850 – If house is 4+ miles from Gulf.

- $2050 – If house is 2+ miles from Gulf.

- $2250 – If house is 1+ miles from Gulf.

- $2400 – If house is ½+ miles from Gulf.

- $2700 – If house is 0 miles from the Gulf.

Here’s what it the price may look like at different distances from the Mobile Bay:

- $950 – If house is North of I-10 & +2 miles from the bay.

- $1550 – If house is ½+ miles from the bay.

- $1700 – If house is 0+ miles from the bay.

2) Being close to a fire station & fire hydrant

Different towns have different protection classes for their fire stations. Some fire stations respond better than others. If your house catches fire, it helps to be somewhat close to a fire station and a fire hydrant for damages to be minimized. Here’s what prices may look like:

- Protection class 3-4 = $950

- Protection class 5-7 = $1000 (5% more $)

- Protection class 8-9 = $1100 (15% more $)

Every town has different protection classes. Sometimes a town has 3 protection classes, for example, class 3, class 6, and class 9. How we figure the class is like this:

- Class 3 = house is less than 5 miles to a fire station and within 500ft of a hydrant.

- Class 6 = house is less than 5 miles to a fire station and between 500-1000ft of a hydrant.

- Class 9 = house is more than 5 miles from a fire station and/or 1000ft+ of a hydrant.

3) Age of the house

Old buildings have problems. That’s just how it goes. The effective age of the house is calculated by 5 things:

- Year the house was built.

- Year the roof was updated.

- Year the plumbing was done.

- Year the wiring was done.

- Year the AC was updated.

All of the update years are added together and divided by 5. The year the house was built can also be updated only if the house is totally renewed and gutted from the inside out. Here’s what prices could look like based off of the age of the house:

- $938 = Age 0-1 ß this is the base price. Every mark up goes by 1.7%, which is about $16 here.

- $954 = Age 2

- $969 = Age 3-4

- $985 = Age 5-6

- $1001 = Age 7-8

- $1017 = Age 9-10

- $1033 = Age 11

- $1049 = Age 12-13

- $1065 = Age 14-15

- $1081 = Age 16-17

- $1097 = Age 18-19

- $1113 = Age 20

- $1128 = Age 21-22

- $1144 = Age 23-24

- $1160 = Age 25-26

- $1176 = Age 27-28

- $1192 = Age 29

- $1208 = Age 30

- AGE 30+ = DISQUALIFIED

Just keep in mind that those are the most favorable conditions. If the base price was $2000, 1.7% of 2000 would be $34. In that situation, the insurance price would jump $34 every couple of years. That doesn’t mean that your policy would go up every couple of years. It just means that when an agent initially quotes a house that the age affects the quote price.

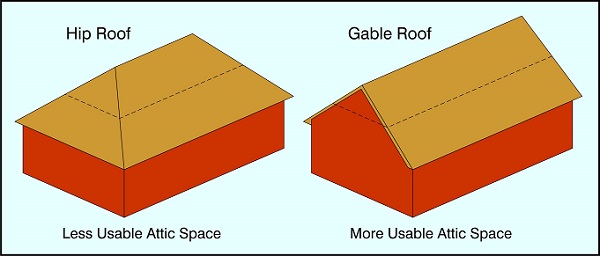

4) Roof type

Roof types are important for wind insurance. If you look at the aerodynamics of each roof type, you can see that hipped roofs are best because the wind can flow over them. There are 3 roof types; hipped, braced gable, flat, and gabled with no brace. Here is what the prices could look like if your house had these kinds of roofs:

- $2300 – Hipped

- $2400 – Braced gable or flat roof

- $2550 – Gable with no brace (usually older roofs)

5) Exterior material

The outside material of your house also affects insurance price. Brick homes are common in Baldwin County, and they’re secure too. Frame and vinyl may be more vulnerable than brick, but they’re cheaper to build. Stucco looks nice and might be expensive, but it’s horrible for insurance. Drivit stucco, also called synthetic stucco, is many times applied to a foam board and can mold, rot, and decay in about 5 years if it’s not kept up with. Here’s what the prices could look like:

- $2300 – brick, solid block, metal

- $2400 – frame, vinyl, hardi, slate, masonite

- $2550 – log, stucco

6) Roofing material

Along with the actual roof type is what material you have on your roof. Standard 3 tab shingles can resist wind speeds of about 55mph. After Hurricane Ivan and Katrina hit in 2004 and 2005, it became more common to build with architectural shingles, also called dimensional shingles. They can resist wind up to 110mph. Any house built in Southern Alabama after 2004 probably has architectural shingles on its roof. A metal roof is the most secure. Here’s an example of possible prices:

- $2100 – Metal

- $2200 – Architectural shingles (110mph)

- $2300 – Standard 3 tab singles (55mph)

Foundation of house

The foundation of your house could possibly affect flood insurance prices. Here’s the breakdown:

Slab – Building on a cement slab is standard for homes in South Alabama. It’s the cheap way to go, but it has its risks. The pipes are built above the ceilings, and sometimes the water heater is too. If the pipes burst or leak, where will the water go? It will go on the ceiling. Of course, the ceiling will be damaged and you’ll want your insurance to cover it.

Crawl space – If your house is built a few feet off the ground, then you’re at an advantage. Crawl spaces under the house can prevent minor flood. Pipes would be built under the house. If the pipes burst, the water would drip under the house and no extra damage would be done.

Piers – Piers are really made for the beach in flood prone areas. There are areas in Gulf Shores where it is part of the building code to build a house on piers. Unless it’s part of the code, building on a crawl space is just fine.

Occupancy

Whether you live in the house or not will affect the price. If you’re renting your house out, the tenants will never take as good of care of the house they’re in as the owner. Of course, a vacant house is the most risky to insure because if a fire starts, no one is there to stop it. But if you have a vacant house and lie to an insurance agent, saying that it was your primary address, your insurance would not pay its claims, plus you’d get canceled.

Insurance “Unfriendly” Things

There are some things that could affect your insurance price in a bad way.

- Trees nearby that could fall on the home.

- Swimming pools & hot tubs without a 6 fence around them.

- Trampolines; a liability accident waiting to happen.

- Animals that might bite people and cause a liability law suit.

- A business on the premises.

If there’s a business ran on or around the house then you need a separate business insurance policy. If you run a business at your house but get homeowners insurance, the best case scenario is that liability is excluded. Liability is the main issue with doing business at home. Imagine that a woman had a preschool or daycare at her house, and then a child got hurt. The child’s parents would sue the woman, and that would be covered by her personal liability.

A quick story… Once, a woman called me who had a daycare sign outside her home. Her insurance provider canceled her, so she was looking for new insurance. She called me, but she still had a sign advertising her daycare outside her home. Her excuse was that she just hadn’t gotten around to taking it down. Now, if you advertize for something, I must assume that you are doing that thing. If there was a sign outside your home saying, “prostitution” or “assassin”, what would people naturally think? It’s a sign that should be removed in any case.

Legal and financial history

Claims, bankruptcy, foreclosure, repossession, arson, and theft on your part can all affect your insurance price. The idea is that if it happened before, it not only can happen again, but it is more likely to happen again. It’s all based on the judgment of the insurance company.

Contact us to save money on house insurance in South Alabama!

Get in touch with us if you’d like to save money on house insurance in South Alabama.

If you have any questions, feel free to call us at 251-945-6666.

Take 2 minutes to get a house insurance quote!

You can also contact us via web forum.